5 Reasons Stocks Hit New Lows

And why the outlook looks rough from here.

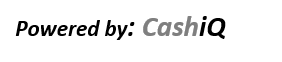

Broad stock market indexes set new bear-market lows this past week, dashing the notion that prices seen earlier this summer would prove to be the bottom, as many strategists had come to believe.

In two short weeks investors have shifted their focus from wondering whether the summer rally from mid-June to mid-August might be revived and possibly extended, to asking whether we are on the brink of global recession. There is even talk of this becoming a secular bear market. That is when there is a long and protracted period of declining returns driven by trends not associated with typical business cycles.

The broad-market Morningstar US Market PR Index set a new low on Sept. 27, surpassing the previous nadir on June 16. The index is down 23.05% for the year through Wednesday and has lost about 8.53% in the last 30 days.

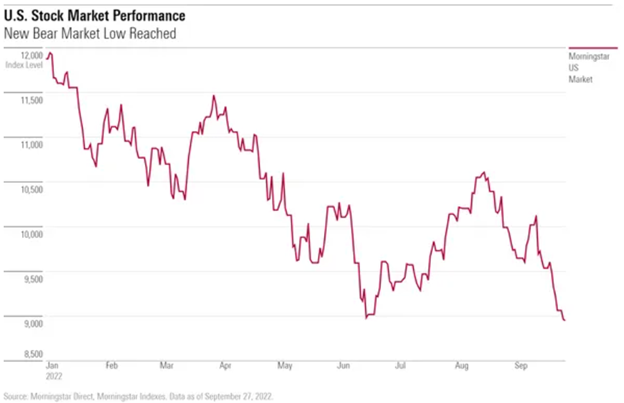

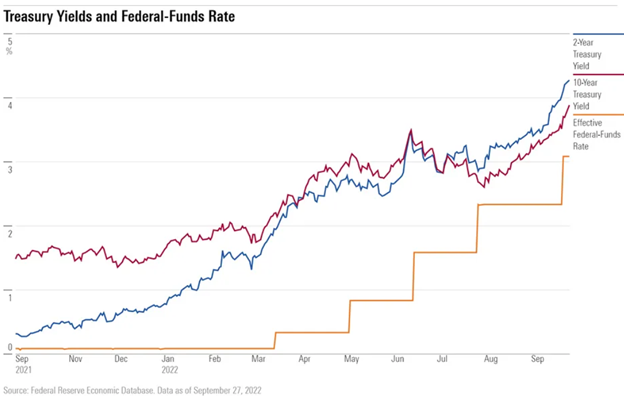

Bond yields have soared to their highest levels in years, with the 2-year Treasury at 4.16% and the 10-year note topping 4% briefly Tuesday for the first time in 14 years, before settling at 3.82%. The credit markets are responding to Federal Reserve projections that the appropriate federal-funds rate will be 4.40% at year-end, 1 percentage point higher than projected in June. Turmoil surrounding budget policies in the United Kingdom under new Prime Minister Liz Truss, concerns about a looming recession in Europe, and slowing growth in China also attracted overseas investors to the perceived haven of the U.S. bond market.

5 Factors Leading to New Lows

What’s changed? You can count on one hand the reasons why markets have plummeted:

- A shockingly high August Consumer Price Index reading. The report released on Sept. 13 showed inflationary pressures were far from peaking, adding pressure on the Fed to maintain its aggressive tightening stance.

- A doozy of a warning from FedEx (FDX) on Sept. 15. The company said its fiscal first-quarter 2023 would be significantly below expectations and withdrew the full fiscal 2023 earnings forecast it provided in late June. The global transport and delivery company cited a decline in global volumes driven by macroeconomic trends, particularly in Asia as well as Europe, that had significantly worsened late in the quarter. It also said it expects conditions to “further weaken” in the second quarter. Its stock plunged 21% during the following trading session.

- A more hawkish Federal Reserve Board raised the federal-funds rate by another 0.75% on Sept. 21. It was the third 0.75% hike in a row and the fifth increase this year, bringing rates to 3.00%. Chair Jerome Powell adopted a sterner tone in describing the central bank’s determination to fight escalating inflation. He vowed the Fed would move rates “purposefully to a level that will be sufficiently restrictive” to bring inflation down to the target 2% level, reiterating past statements that it “will likely require maintaining a restrictive policy stance for some time” and that it is “likely to require a sustained period of below-trend growth.”

- A surging U.S. dollar that is gaining strength from rising rates. The stronger dollar is pressuring corporate earnings. It is also driving other currencies lower, which in turn, leads foreign investors to flock to the safe haven of U.S. Treasuries, driving up yields and making bonds a more attractive alternative to equities.

- A deceleration in earnings growth and lowered expectations. Earnings estimates for the third and fourth quarter of this year and each of next year’s quarters have been cut, according to Yardeni Research, a global investment research and advisory firm. Stock performance is closely tied to earnings growth. In addition to the revisions in earnings, the forward price/earnings multiple fell to 15.4 on Sept. 26 from 16.2 on Sept. 20. When multiples are expanding, it's a sign of confidence that companies’ earnings and cash flows will be increasing and investors are willing to pay a higher price for those profits. Conversely, when multiples contract, investors are discounting deteriorating earnings and paying lower prices for those earnings.

FedEx’s warning was a shot across the bow on the earnings front. Other companies, including General Electric, Alcoa, Nucor, and U.S. Steel, have also said recently a rapid deterioration in market conditions is hurting results.

As a result of the changing dynamics, market strategists have adopted more cautious stances.

What Is Next for Markets?

Ned Davis Research chief global investment strategist Tim Hayes, for instance, switched his recommendation to an underweight position in global equities Monday, shifting 10% to cash. The firm now recommends allocating 50% to stocks (5% underweight), 35% to bonds (market weight), and 15% to cash (5% overweight). Hayes called NDR’s August upgrade to a 5% overweight in global equities “premature” as the June 16 low didn’t hold.

He noted that clients are increasingly concerned about the possibility of a long and severe secular bear market as opposed to a short and mild bear within a secular bull market.

Richard Bernstein Advisors told clients in a note that the “probability for negative returns is the highest under the relatively certain scenario we envision.”

“We prefer to structure portfolios for the only two certainties we see for the next 6-12 months: the Fed will be tightening and profits will be decelerating,” said the firm’s analysts. “This combination of events is not typically a good one for equity markets, and we now have our lowest equity beta and highest cash levels in years.”

Even the most optimistic of strategists concede it will take clearer evidence that the Fed’s rate policies are working before there is a possibility that the central bank can lighten its grip on the economy, which would allow the stock market to return to an upward flight path.

By raising the cost of borrowing and reducing the demand for goods and services, as well as for jobs, the Fed hopes to bring about price stability throughout the economy. The risk is that the economy is thrust into recession.

“Perversely, it’s going to take weak economic indicators to rally the market,” says Ed Yardeni, president and chief investment strategist at Yardeni Research

By Sandy Ward

Sept 28, 2022

Via Morningstar.com